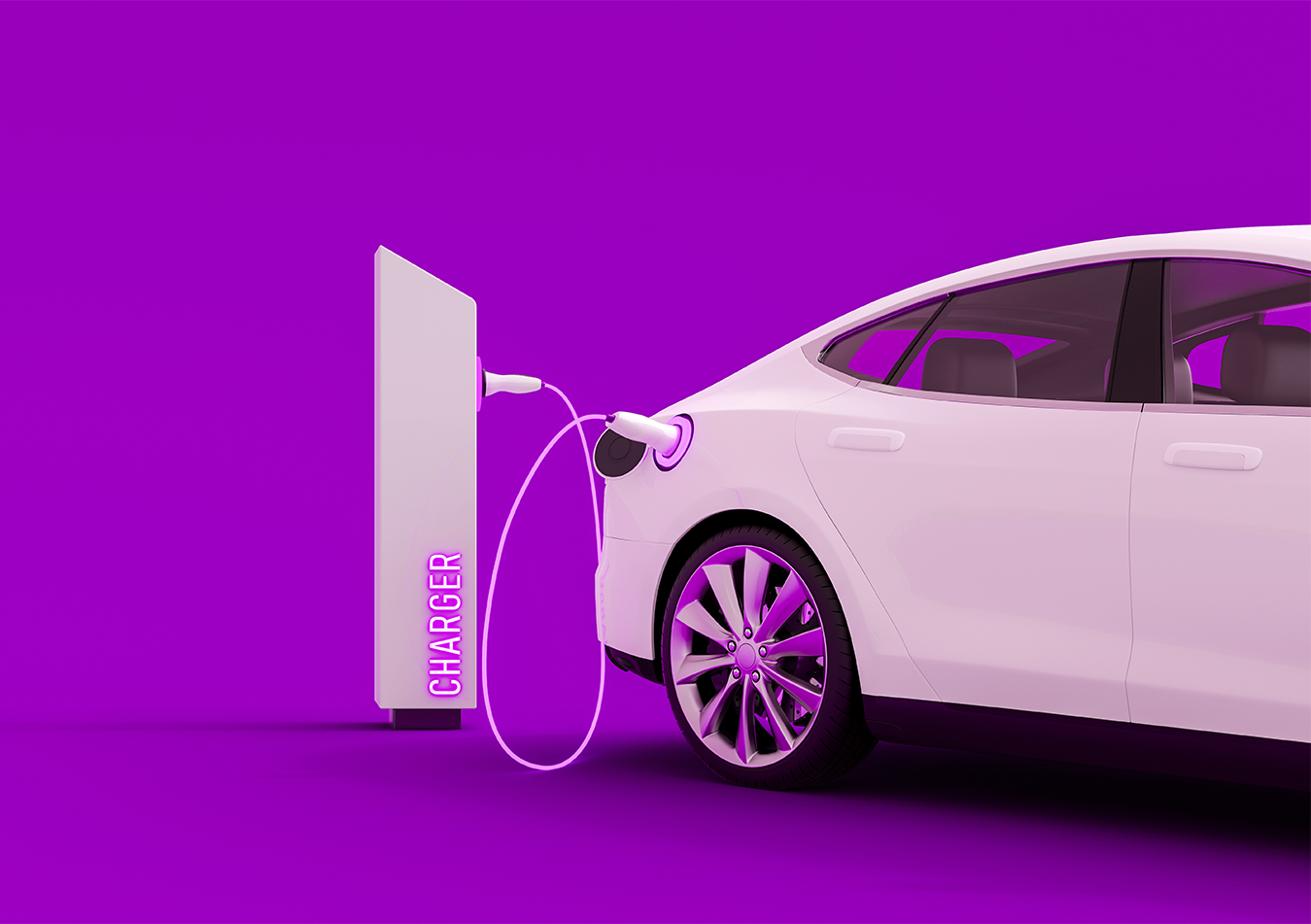

Clean Transport Sales Rise, Opportunities Grow

Americans are planning to begin, and end, their holiday shopping earlier than ever before. This year, over one-third of U.S. consumers said that they planned to start their holiday shopping before the end of October, and over 50% said they would complete their shopping before Cyber Monday, which occurs at the end of November.

This does not bode well for a supply chain that’s already stretched beyond capacity. Factors including product and employee shortages, combined with a heightened need for online shopping services, is pushing the transportation industry to its limit. While this may seem like a difficult challenge to overcome, clean transport solutions are available that would not only help mitigate shipping issues, but create a successful and sustainable system for the future.

Here are a few exciting opportunities for growth that signal a promising future for the clean transport industry.

1. COP26 energizes the shift to clean transport

At COP26, over 100 parties, from governments, businesses, and investors, committed to a 100% zero-emission transport future. Road transport currently accounts for 10% of global emissions, and its emissions are rising faster than those of any other sector. This has the potential to quickly and effectively accelerate clean transport’s adoption. The signatories account for nearly 1/3rd of global car sales by government commitment, and 25% of global car sales by automaker commitment.

2. EV industry continues to surge

Backed by an ever-increasing demand for electric alternatives, sales of pure electric and plug-in hybrid passenger vehicles are on pace to more than double in 2021, to a record 6.2 million units, according to S&P Global Market Intelligence data. These are positive figures by all standards, but what do they mean for company profits, and how will electric vehicles affect the economy as a whole? There have been hesitations about electric vehicles’ ability to produce profits, but margins are becoming more feasible every day.

When asked about GM’s ambitions for the electric vehicle industry, Doug Parks, GM’s Executive VP of Global Product Development stated, “We want to lead in this space. We don’t just want to participate, we want to lead.” “Tesla’s got a good jump and they’ve done great things. They’re formidable competitors … and there’s a lot of start-ups and everyone else invading this space. We’re not going to subside leadership there.”

Almost all auto manufacturers are gearing up for an electric transition, from VW to Ford. Ford shares surged this year as they announced plans to invest $29 billion in electric and self-driving vehicles by 2025. BMW is introducing an electric-focused platform by mid-decade and expects it to deliver returns on par with combustion-engine models. “The fact that BMW is sticking to its long-term margin target shows that the manufacturer is confident on EV profitability”, said BMW CFO Nicolas Peter.

The auto manufacturer reported third quarter net quarter profits of EUR 2.58 billion, surpassing analysts’ expectations with a 42.4% year on year increase during the three-month window. According to company statements, the outperformance of profits is bolstered by skyrocketing sales of EVs and adjusted pricing. “A better product mix and good price setting of new vehicles alongside a stable pricing trend of used vehicles strengthened the financial performance of the business,” the company statement said, underscoring the importance of EVs adding diversity to the marketplace.

3. Ride sharing services join the wave

Public services such as ride sharing giants Uber and Lyft are joining the transition as well, making efforts to transition their fleet of vehicles to electric. California just approved the first rule in the U.S. requiring ridesharing operators to transition away from gasoline by the end of the decade. “Uber shares California’s climate and EV goals and applauds the Clean Miles Standard as one of the first emissions policies in the world based on real-world vehicle use,” said Adam Gromis, Uber’s global head of sustainability.

Uber recently committed over $800 million to help their drivers shift to electric vehicles, the company also has a target of converting all its rides to electric power by 2040. Lyft has a more aggressive target, pushing to convert all rides to electric by 2030. Uber also intends to contribute “resources and partnerships across the e-mobility value chain to leverage existing State policies for the benefit of lower income part- and full-time commercial drivers,” Gromis said.

In further news, Tesla hit a $1 trillion market cap on Monday following news that Hertz is ordering 100,000 vehicles to build out its electric vehicle rental fleet by the end of 2022. Hertz Interim CEO Mark Fields shed light on why the car rental agency has decided to enter the world of EV’s. “When you look over the next 12 to 36 months, I think there’s gonna be about 100 EV models coming into the marketplace,” Fields said. “So you have this combination of customer intent or predisposition rising, and you have the products coming.”

4. US Build Back Better bill plans ambitious growth for infrastructure

President Biden signed a sweeping $1 trillion infrastructure bill this month, described as the “most important step in a generation towards upgrading the nation’s roads, ports, rails, and more.” The bill allocated over $7.5 billion to electric vehicles, and $66 billion for rails across the United States. The cost of an electric vehicle made in the U.S., using domestically-sourced materials, will be cut $12,500, the White House said.

Electric vehicles are being manufactured and purchased at an unprecedented rate. “This is one of the biggest transformations since the industrial revolution, and it’s not just transforming what powers the car,” said Josh Boone, executive director of EV advocacy group Veloz. “It is a seismic shift in how the energy sector and the transportation sector interact,” Boone said. The opportunities electric vehicles present consumers and manufacturers alike is undeniable. With global revenue expected to break $1.9 trillion in 2025, their adoption into the mainstream shows no signs of slowing down.

Leave a Reply